of Shareholders of ELANCO ANIMAL HEALTH INCORPORATED, an Indiana corporation, willto be a virtual meeting of shareholders, conducted via live audio webcast at www.virtualshareholdermeeting.com/ELAN2022Held

on Wednesday, May 18, 2022, at 8:00 a.m., Eastern Time, to consider and act upon the following matters:30, 2024

ELANCO ANIMAL HEALTH INCORPORATED 2500 Innovation Way Greenfield, Indiana 46140 | The 2024 Annual Meeting of Voting Matters: | ||

Date & Time 12:00 p.m., Eastern Time, Thursday, May 30, 2024

Location Audio webcast at: virtualshareholdermeeting.

Record Date Close of business on April 11, 2024 | 1 | Election of | |

Ratification of the appointment of Ernst & Young LLP as Elanco’s independent registered public accounting firm for 2024. | |||

Management proposal to amend Elanco’s Articles of Incorporation to adopt a majority vote standard for uncontested elections of directors. | |||

| Management proposal to amend Elanco’s Articles of Incorporation to provide shareholders with the right to request special meetings of shareholders. | |||

| In addition, we will transact such other business as may properly come before the meeting. | |||

This Notice and the accompanying Proxy Statement, or a Notice of Internet Availability of Proxy Materials, are expected to be mailed to shareholders commencing April [•], 2024. By Order of the Board of Directors, Shiv O'Neill Executive Vice President, General Counsel and Corporate Secretary April [•], 2024 | |||

Voting

Even though you may plan to participate in the meeting online, please vote by telephone or the Internet, or execute the proxy card and mail it promptly. Telephone and Internet voting information is provided on the notice mailed to you or in this proxy statement.Proxy Statement. If you participate in the virtual meeting, you may revoke your proxy and vote your shares electronically during the meeting.

The Notice of 20222024 Annual Shareholders Meeting, Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

Table of

Contents

WAYS TO VOTE

Online Prior to the Annual Meeting You may vote by proxy by visiting www.proxyvote.com and entering the control number found on your Notice of Internet Availability.

Online During the Annual Meeting You may vote online during the Annual Meeting by visiting www.virtualshareholder meeting.com/ELAN2024

Telephone If you request printed copies of the proxy materials by mail, you will receive a proxy card or voting instruction form and you may vote by proxy by calling the toll-free number found on the card or form.

If you request printed copies of the proxy materials by mail, you will receive a proxy card or voting instruction form. | This summary highlights information contained in this Proxy Statement. This summary does not contain all of the information that you should consider and you should carefully read the entire Proxy Statement before voting.

Voting Matters and Recommendations

| ||||

| Item of Business | Board Recommendation | Page | |||

| 1 | Election of four director nominees to serve three-year terms. | “FOR” Each Nominee | 9 | ||

| 2 | Ratification of the appointment of Ernst & Young LLP as Elanco’s independent registered public accounting firm for 2024. | “FOR” | 47 | ||

| 3 | Advisory vote on the compensation of Elanco’s named executive officers. | “FOR” | 50 | ||

| 4 | Management proposal to amend Elanco’s Articles of Incorporation to declassify the Board of Directors. | “FOR” | 87 | ||

| 5 | Management proposal to amend Elanco’s Articles of Incorporation to adopt a majority vote standard for uncontested elections of directors. | “FOR” | 89 | ||

| 6 | Management proposal to amend Elanco’s Articles of Incorporation to provide shareholders with the right to amend our Bylaws. | “FOR” | 91 | ||

| 7 | Management proposal to amend Elanco’s Articles of Incorporation to provide shareholders with the right to request special meetings of shareholders. | “FOR” | 93 | ||

| 2024 Proxy Statement |

Director Nominees and Continuing Directors

| Name | Primary Occupation | Age | Director Since | Independent |

| CLASS I DIRECTORS — Terms Expiring in 2025 | ||||

| Kapila Anand | Retired Partner, KPMG LLP | 70 | 2018 |  |

| John Bilbrey | Former Chairman, CEO and President, The Hershey Company | 67 | 2019 |  |

| Paul Herendeen | Former CFO, Bausch Health Companies, Inc. | 68 | 2020 |  |

| Lawrence Kurzius | Executive Chairman, McCormick & Company, Inc. | 66 | 2018 |  |

| Craig Wallace | President, C.S. Wallace Investments + Strategy | 60 | 2024 |  |

| CLASS II DIRECTORS— Terms Expiring in 2026 | ||||

| Michael Harrington | Former General Counsel, Eli Lilly and Company | 61 | 2018 |  |

| R. David Hoover | Former Chairman and CEO, Ball Corporation | 78 | 2018 |  |

| Deborah Kochevar | Senior Fellow, The Fletcher School of Law and Diplomacy and Dean Emerita, Cummings School of Veterinary Medicine, Tufts University | 67 | 2019 |  |

| Kirk McDonald | Former CEO, Group M North America | 57 | 2019 |  |

| Kathy Turner | Former Senior Vice President and Chief Marketing Officer, IDEXX | 60 | 2024 |  |

| CLASS III DIRECTORS— Director Nominees for Terms Expiring in 2027 | ||||

| William Doyle | Executive Chairman, Novocure Ltd. | 61 | 2020 |  |

| Art Garcia | Former CFO, Ryder System, Inc. | 63 | 2019 |  |

| Denise Scots-Knight | Co-Founder and CEO, Mereo BioPharma Group plc | 64 | 2019 |  |

| Jeffrey Simmons | President and CEO, Elanco Animal Health Incorporated | 56 | 2018 | |

Our Board Highlights

| 2024 Proxy Statement |

Items of Business | | | Board Recommendation | | | Page | |||

1 | | | Election of the five director nominees to serve three-year terms. | | | “FOR” Each Nominee | | | 5 |

2 | | | Ratification of the appointment of Ernst & Young LLP as Elanco’s independent registered public accounting firm for 2022. | | | “FOR” | | | 41 |

3 | | | Advisory vote on the compensation of Elanco’s named executive officers. | | | “FOR” | | | 44 |

4 | | | Approval of the Elanco Animal Health Incorporated Employee Stock Purchase Plan. | | | “FOR” | | | 68 |

5 | | | Management proposal to amend Elanco’s Articles of Incorporation to eliminate supermajority voting. | | | “FOR” | | | |

6 | | | Management proposal to amend Elanco’s Articles of Incorporation to eliminate legacy parent provisions. | | | “FOR” | | | 72 |

|

| | | | Committee Memberships | | |||||||||||||||||||||||||

| | Name | | | Primary Occupation | | | Age | | | Director Since | | | Independent | | | AC | | | CC | | | FOC | | | ISTC | | | NCGC | |

| | Class I Director Nominees | | | | | | | | | | | | | | | | | | |||||||||||

| | Kapila Kapur Anand | | | Retired Partner, KPMG LLP | | | 68 | | | 2018 | | |  | | |  | | | | | | | | |  | | |||

| | John P. Bilbrey | | | Former Chairman and CEO, The Hershey Company | | | 65 | | | 2019 | | |  | | |  | | | | |  | | | | | | |||

| | Scott D. Ferguson | | | Founder and Managing Partner, Sachem Head Capital Management | | | 47 | | | 2020 | | |  | | | | | | |  | | | | | | ||||

| | Paul Herendeen | | | Former Chief Financial Officer, Bausch Health | | | 66 | | | 2020 | | |  | | | | | | |  | | | | | | ||||

| | Lawrence E. Kurzius | | | Chairman and CEO, McCormick & Company | | | 64 | | | 2018 | | |  | | | | |  | | | | | | |  | | |||

| | Class II Directors — Terms Expiring in 2023 | | | | | | | | | | | | | | | | | | |||||||||||

| | Michael J. Harrington | | | Former General Counsel, Eli Lilly and Company | | | 59 | | | 2018 | | |  | | | | | | | | |  | | | | ||||

| | R. David Hoover (Chairman) | | | Former Chairman and CEO, Ball Corporation | | | 76 | | | 2018 | | |  | | | | |  | | | | | | |  | | |||

| | Deborah T. Kochevar | | | Senior Fellow, Fletcher School of Law and Diplomacy, Tufts University | | | 65 | | | 2019 | | |  | | | | | | | | |  | | |  | | |||

| | Kirk P. McDonald | | | CEO, Group M North America | | | 55 | | | 2019 | | |  | | | | |  | | | | |  | | | | |||

| | Class III Directors — Terms Expiring in 2024 | | | | | | | | | | | | | | | | | | |||||||||||

| | William F. Doyle | | | Executive Chairman, Novocure Ltd. | | | 59 | | | 2020 | | |  | | | | | | |  | | |  | | | | |||

| | Art A. Garcia | | | Former CFO, Ryder System, Inc. | | | 60 | | | 2019 | | |  | | |  | | | | |  | | | | | | |||

| | Denise Scots-Knight | | | Co-Founder and CEO, Mereo BioPharma Group plc | | | 62 | | | 2019 | | |  | | | | |  | | | | |  | | | | |||

| | Jeffrey N. Simmons | | | President and CEO, Elanco Animal Health Incorporated | | | 54 | | | 2018 | | | | | | | | |  | | | | | | |||||

|

We are committed to the values of effective corporate governance and high ethical standards. As a young public company, weWe continue to evolve our Board and our corporate governance practices. Many of our changes have been influenced by the valuable feedback we have received from our shareholders and other stakeholders who provide important external viewpoints that help inform our decisions. For more information about our corporate governance practices, including several enhancements we have made since December 2020, see “Corporate Governance” beginning on page 2227below.

Independent Oversight | |||||

| | • | All directors, including our Board Chairman, are independent, except for our CEO | |||

• | Four Board | ||||

• | Regular executive sessions of independent directors at Board meetings (chaired by the independent Board Chairman) and Committee meetings (chaired by the independent | ||||

• | Active Board and committee oversight of our strategy and risk management, including ESG-related matters | | |||

Board Refreshment and Practices | |||||

| | • | ||||

including two in 2024 • | |||||

Comprehensive, ongoing Board succession planning process | |||||

• | Annual Board and committee self-assessments led by the independent | ||||

• | Board policy limits director membership on other public company boards | ||||

• | Continuing director education on key topics and issues • Changes proposed for shareholder approval at the Annual Meeting: - Commence a process to declassify the Board beginning at the 2025 annual meeting of shareholders - Adopt a majority vote standard for uncontested elections of directors - Right of shareholders owning a majority of votes entitled to be cast to amend the Bylaws - Right of shareholders owning at least 25% of common stock to request special meeting of shareholders | | |||

Shareholder Rights | |||||

| | • | 3%/3 years proxy access right for shareholders, | |||

adopted in 2022 • | Shareholders can approve amendments to our Articles of Incorporation and Bylaws with a simple majority vote • One class of outstanding shares with each share entitled to one vote | | |||

Governance Practices | |||||

| | • | Code of Conduct applicable to all employees and directors • Corporate Governance Guidelines and Financial Code of Ethics • Clawback policy applicable to executives • Rigorous executive stock ownership requirements • Prohibition on hedging or pledging Elanco stock | |||

• | |||||

Regular review of succession planning for CEO and other key executives | |||||

• | |||||

• | Comprehensive shareholder engagement program with independent director participation | |

Elanco Animal Health Incorporated | 3 | 2024 Proxy Statement |  |

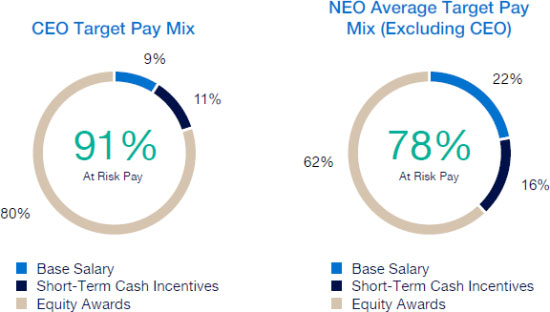

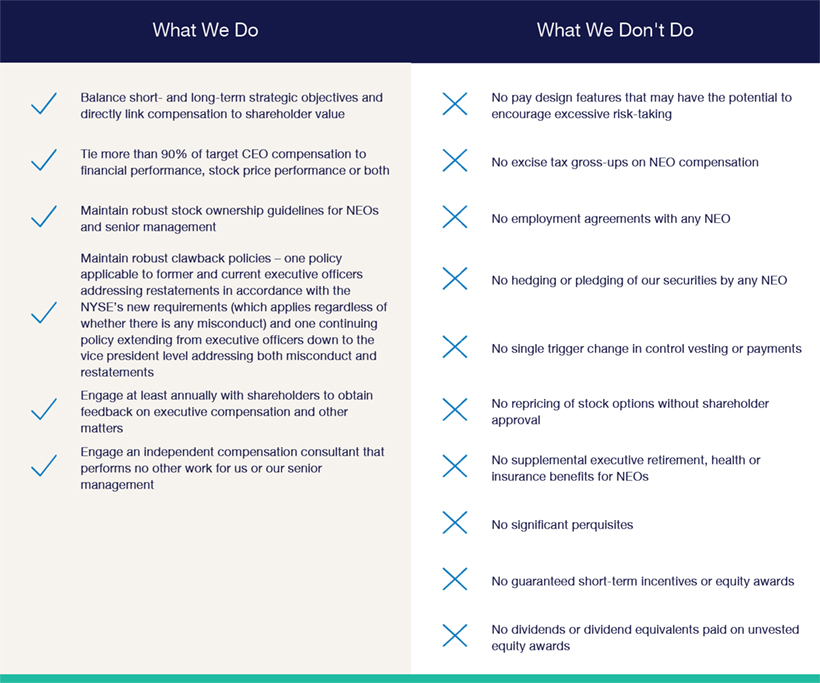

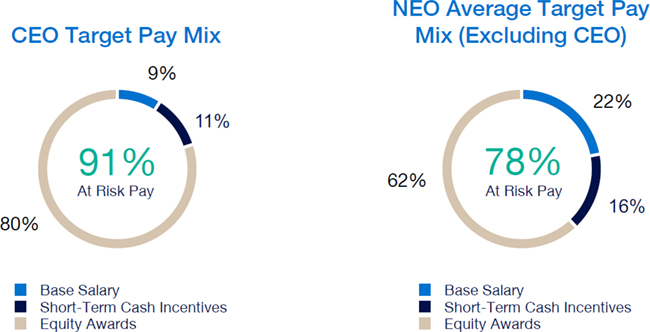

Our executive compensation programs areprogram is designed to help achieve the goals of attracting, engaging and retaining highly talented individuals who are committed to our core values of integrity, excellence and respect for people, while balancing the long-term interests of shareholders and customers. We accomplish this, in part, by delivering senior executive pay with a greater emphasis on equity and lower weighting on cash to promote an ownership mentality and help ensure shareholder alignment.

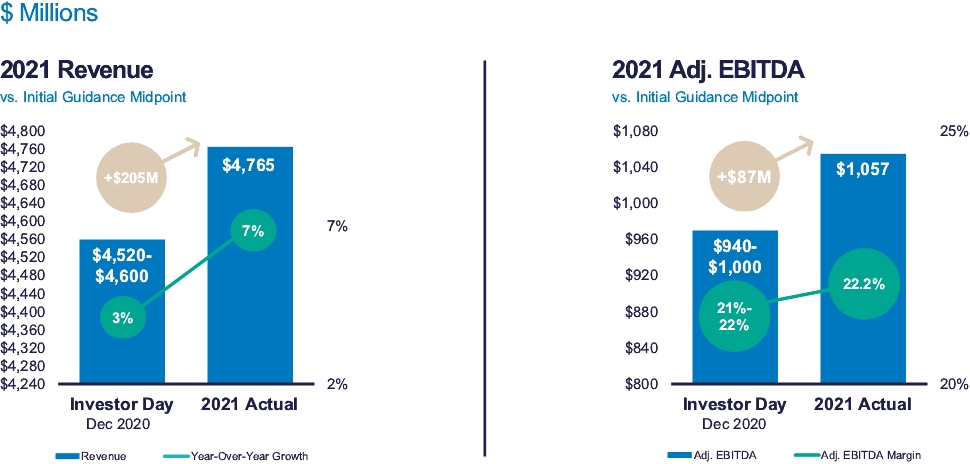

Highlights for 2023 include:

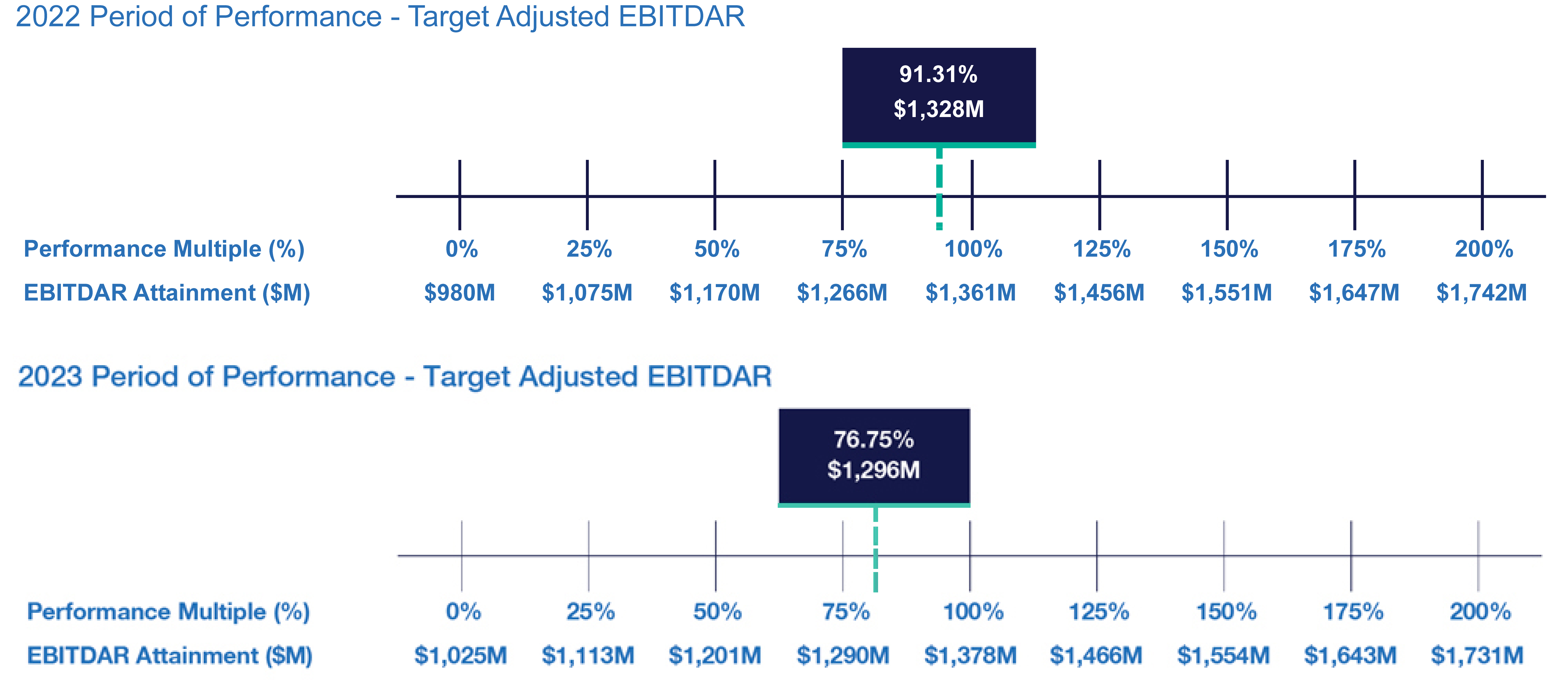

| • | Continued use of Elanco Cash Earnings (ECE) and Adjusted EBITDAR as incentive metrics to focus on productivity efforts, reinforce strong balance sheet management, and align with shareholder interests |

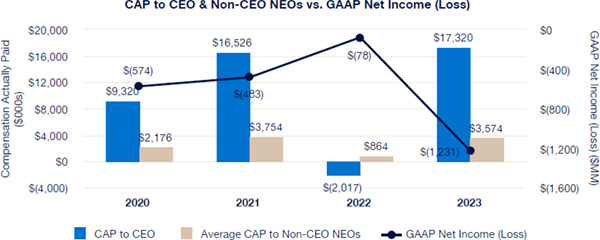

| • | Payouts of both annual cash incentives and performance share awards for performance periods ended in 2023 were both below 80% of target, reflecting a rigorous pay-for-performance discipline |

| • | Compensation program reflected continued mix of compensation elements, with substantial portion of compensation tied to our operating and financial performance and the performance of our stock price, as set forth below: |

| • | 2023 marked culmination of the “glidepath” trajectory, with all named executive officers now receiving target compensation opportunities at or near peer median levels |

| Elanco Animal Health Incorporated | 4 | 2024 Proxy Statement |

|

| Elanco Animal Health Incorporated | 2024 Proxy Statement |

| Elanco Animal Health Incorporated | 7 | 2024 Proxy Statement |

| Elanco Animal Health Incorporated | 8 | 2024 Proxy Statement |

Proposal No. Election of Directors | ||

Under our Amended and Restated Articles of Incorporation (our “Articles of Incorporation”), our Board is divided into three classes with approximately one-third of the directors standing for election each year. Our Board currently consists of thirteen14 directors. The directors hold office for staggered terms of three years (and until their successors are elected and qualified, or until their earlier death, resignation, or removal). One of the three classes is elected each year to succeed the directors whose terms are expiring.

The “Class I”Class III directors whose terms expire at the Annual Meeting are Kapila K. Anand, John P. Bilbrey, Scott D. Ferguson, Paul Herendeen,William Doyle, Art Garcia, Denise Scots-Knight, and Lawrence E. Kurzius.Jeffrey Simmons. Each of these directors has been re-nominated by our Board upon the recommendation of its Nominating andour Corporate Governance Committee (the “Nominating and Corporate Governance Committee”).Committee. All directors elected at the Annual Meeting will continue in office until the annual meeting of our shareholders to be held in 20252027 and until their successors are elected and qualified.

The fivefour nominees contribute significantly to our Board, including as follows:

| • | All nominees, other than Mr. Simmons, are independent directors; |

| • | Two of the four nominees are public company CEOs; |

| • | One of the four nominees is a former public company CFO; |

| • | One of the four nominees has significant experience leading and serving on public boards of animal health and life sciences companies; and |

| • | Three of the four nominees serve or have served on other public boards. |

Each of the directors nominated by our Board has consented to serving as a nominee for the term listed above, to being named in this Proxy Statement and to serving on our Board for the term listed above, if elected. The persons named as proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, for the election of each of our Board’s fivefour nominees. If any nominee is unable to serve, our Board can either designate a substitute nominee to serve in his or her place as a director or reduce the size of our Board. If our Board nominates another individual, the persons named as proxies may vote for such substitute nominee. Proxies cannot be voted for a greater number of individuals than the fivefour nominees named in this Proxy Statement.

Our Board has determined that all director nominees, other than Mr. Simmons, are independent of Elanco and management. See “Corporate Governance—Director Independence” below for more information.

Recommendation of the Board

| The Board unanimously recommends a vote “FOR” each of Elanco's Class III director nominees. | ||

| Elanco Animal Health Incorporated | 9 | 2024 Proxy Statement |

| Elanco Animal Health Incorporated | 10 | 2024 Proxy Statement |

| Elanco Animal Health Incorporated | 11 | 2024 Proxy Statement |

Board Membership Criteria

Our Board is responsible for selecting candidates for Board membership and for establishing the general criteria to be used in identifying potential candidates. The Nominating andBoard has delegated to the Corporate Governance Committee leadsits authority to lead our director succession planning process and regularly considers the criteria necessary to achieve a diverse Board that provides effective oversight of Elanco.

The Nominating and Corporate Governance Committee believes that all directors should display the personal attributes necessary to be effective directors: integrity, sound judgment, intellectual prowess and versatility, confidence, independence in fact and mindset, ability to operate collaboratively, willingness to ask difficult questions, willingness to listen, the ability to commit the necessary time to

|

In addition to the above criteria, the Corporate Governance Committee considers, on an ongoing basis, the additional skills, experiences and backgrounds that it seeks in members of our Board in the context of our business and the existing composition of our Board. The directors’ biographies under “—Our Director Nominees and Continuing Directors” below note each director’s relevant skills, experiences and backgrounds that make them suited to contribute to our Board.

Public Company Board Commitments

Our Corporate Governance Guidelines state that directors shall ensure that existing or future commitments do not materially interfere with their ability to fulfill their responsibilities as Elanco directors, given that serving on our Board requires significant time and attention. In general, directors who are not Elanco employees (“Non-Employee Directors”non-employee directors”) may not serve on more than three other public company boards and our Chief Executive Officer may not serve on more than one other public company board.

Elanco Animal Health Incorporated | 2024 Proxy Statement |

|

Our Director Nominees and Continuing Directors

Our Board and the Nominating and Corporate Governance Committee believe that each of our nominees brings a strong and diverse set of skills, experiences and perspectives that, when combined with the other continuing directors, creates a high-performing Board that is aligned with our business strategy and which contributes to the effective oversight of Elanco. The ages, principal occupations, public directorships held and other information about our nominees and continuing directors are shown below as of March 15, 2022.below.

CLASS IIII DIRECTORS – TERMS EXPIRING AT THE ANNUAL MEETINGMEETING;

NOMINEES FOR TERMS EXPIRING IN 2027

| William Doyle EXPERIENCE ● Executive Chairman, Novocure Ltd., a commercial stage oncology company (since 2016) ● Managing Director, WFD Ventures LLC, a private venture capital firm he co-founded (2002 – 2022) ● Senior Advisor and member of the investment team, Pershing Square Capital Management (2013 – 2016) ● Johnson & Johnson (1995 – 1999) - Member, Medical Devices and Pharmaceutical Group Operating Committee - Vice President, Licensing and Acquisitions - Chairman, Medical Devices Research and Development Council - Worldwide President, Biosense-Webster, Inc. - Member of the boards of Cordis Corporation and Johnson & Johnson Development Corporation, Johnson & Johnson’s venture capital subsidiary ● Management consultant, McKinsey & Company OTHER CURRENT AND PRIOR PUBLIC COMPANY BOARDS ● ProKidney Corp. (since 2022) ● Novocure Ltd. (since 2004); Chairman (2009 – 2016) ● Minerva Neurosciences, Inc. (2017 – 2023) ● OptiNose, Inc. (2004 – 2020) ● Zoetis Inc. (2015 – 2016) KEY QUALIFICATIONS ● Animal Health/Health Care Industry experience, gained through his service in roles of increasing responsibility at Johnson & Johnson, his current role at Novocure, and as a director of companies in the healthcare sector, such as OptiNose and Minerva Neurosciences, and the pet health sector, such as Zoetis ● M&A and Business Development experience acquired through his oversight responsibilities while at Johnson & Johnson's venture capital arm and illustrated by Novocure revenue growth of more than $500 million and adjusted EBITDA growth by hundreds of millions of dollars while he served as its Executive Chairman ● Research and Development/Innovation expertise developed through his co-founding and service as Managing Director of WFD Ventures, a technology and life sciences focused venture capital firm, which resulted in a broad understanding of new technologies and emerging business models and risks, as well as through his tenure at Johnson & Johnson, where he managed innovation programs ● Institutional Investor Perspective gained while serving at Pershing Square, a well-known activist hedge fund | |||

Age: 61 Independent Director since: December 2020 | ||||

BOARD COMMITTEES Finance, Strategy and Oversight Innovation, Science and Technology | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 13 | 2024 Proxy Statement |

| Art Garcia EXPERIENCE ● Ryder System, Inc., a North American provider of transportation and | - Executive Vice President and Chief Financial Officer (2010 – 2019) - Senior Vice President and Controller (2005 – 2010) - Vice President and Controller (2002 – 2005) OTHER CURRENT PUBLIC COMPANY BOARDS ● Raymond James & Associates (since 2023) ● American Electric Power Company, Inc. (since 2019) ● ABM Industries Incorporated (since 2017) KEY QUALIFICATIONS ● Business Leadership and Operations expertise acquired through his experience leading the finance organization at Ryder Systems, where he led the re-engineering of the organization to help drive efficiency, established a new business model and implemented strategies to revitalize growth and improve profitability ● Finance and Accounting experience developed during the 18 years he served in financial roles at Ryder Systems, where he ultimately had oversight of the entire financial function for almost a decade and during his service on the audit, risk management and governance committees on the boards of other public companies ● M&A and Business Development expertise obtained while overseeing the corporate strategy and business development functions and managing the financial integration of numerous acquisitions at Ryder Systems ● Institutional Investor Perspective developed through his nearly 10 years of experience engaging with the financial community as a public company Chief Financial Officer | |||

Age: 63 Independent Director since: May 2019 | |||||

BOARD COMMITTEES Audit Finance, Strategy and Oversight | |||||

QUALIFICATIONS

| |||||

| Elanco Animal Health Incorporated | 14 | 2024 Proxy Statement |

| Denise Scots-Knight EXPERIENCE ● Co-Founder, Chief Executive Officer and Director, Mereo BioPharma Group plc, an international biopharmaceutical company focused on oncology and rare diseases (since 2015) ● Partner, Phase4 Ventures GP Ltd., Phase4 Ventures GP III Ltd., Phase4 Ventures III FPGP Ltd., Phase4 Ventures III GP LP, and Phase4 Ventures III FP LP, privately held global life science venture capital firms (2010 – 2019) ● Chief Executive Officer, Phase4 Partners Ltd., a privately held, global life science venture capital firm (2010 – 2015) ● Head, Nomura Phase4 Ventures, a venture capital affiliate of Nomura International plc, a leading Japanese financial institution (2004 – 2010) OTHER CURRENT AND PRIOR PUBLIC COMPANY BOARDS ● Mereo BioPharma Group plc (since 2015) ● OncoMed Pharmaceuticals Inc. (2008 – 2018) ● Albireo Pharma, Inc. (2008 – 2017) KEY QUALIFICATIONS ● Health Care Industry experience acquired over her career in the life sciences industry, and through her current and past service as a director of other public and privately held biotech and life sciences companies and supported by being named of one of the ● Global Business Experience gained through her service as Co-Founder and Chief Executive Officer of Mereo BioPharma, a United Kingdom-based, Nasdaq-listed company with operations in the U.S., as well as leadership roles in other non-U.S. organizations, which further developed her valuable insights into global strategic oversight, talent and leadership development that are critical in our growth-oriented industry ● Institutional Investor Perspective obtained through her extensive experience investing and allocating capital as the head of a life sciences-focused venture capital firm ● Research and Development/Innovation expertise developed through her career, where she has a track record of building new innovation models and strategic partnerships for emerging technologies, which has resulted in her having a deep acumen and technical expertise beneficial for overseeing our research and development activities | |||

Age: 64 Independent Director since: March 2019 | ||||

BOARD COMMITTEES Compensation and Human Capital Innovation, Science and Technology | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 15 | 2024 Proxy Statement |

| Jeffrey Simmons EXPERIENCE ● President and Chief Executive Officer, Elanco Animal Health Incorporated (since 2018) ● Eli Lilly and Company, a global pharmaceutical company (1989 - 2018) - Senior Vice President and President of the Elanco Animal Health division at Eli Lilly (2008 – 2018) - Held various leadership roles in the Elanco Animal Health division, including International Marketing Manager, Country Director for Brazil, Area Director for Western Europe and Executive Director for U.S. and Global Research & Development KEY QUALIFICATIONS ● Business Leadership and Operations expertise exhibited as a proven, purpose-driven leader during his 30-plus years in the life sciences industry, including as the head of Elanco for the past decade, during which he directed Elanco's growth and transformation from a primarily U.S. livestock feed additive company to a global animal health leader with a diversified business, more than quadrupled revenue, created a unique innovation engine and built five new businesses, including a greater than $2 billion pet health business ● M&A and Business Development experience acquired while evaluating, executing and integrating several significant acquisitions during his tenure as Elanco’s CEO, including the acquisitions of Aratana Therapeutics, Kindred Biosciences and Bayer Animal Health, one of the largest animal health transaction to date ● Risk Management and Sustainability expertise shown when under his leadership, Elanco deepened its commitment to sustainability and, in October 2020, became the first independent animal health company to launch sustainability commitments connected to the United Nations Sustainable Development Goals; also demonstrated by his role in progressing Bovaer, Elanco’s methane reduction product, and developing a carbon insetting marketplace ● Research and Development/Innovation experience acquired through his oversight of research and development programs over the past three decades, including the successful product launch of numerous animal health blockbuster drugs while serving as Executive Director for U.S. and Global Research & Development as well as other senior leadership roles within the Elanco Animal Health Division of Eli Lilly | |||

Age: 56 Director since: September 2018 | ||||

BOARD COMMITTEES Finance, Strategy and Oversight | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 16 | 2024 Proxy Statement |

CLASS I DIRECTORS – TERMS EXPIRING IN 2025

| Kapila Anand EXPERIENCE ● KPMG LLP, one of the world's leading accounting firms - Senior Advisor (2016 - Audit Signing Partner and Advisory Partner (1989 - Elected to | |||

OTHER CURRENT AND PRIOR PUBLIC COMPANY BOARDS ● Omega Healthcare Investors Inc. ● Extended Stay America, Inc. and its REIT subsidiary, ESH Hospitality, Inc. (2016 | ||||

KEY QUALIFICATIONS ● Finance and ● Risk Management and Sustainability expertise developed over her career advising companies throughout their life cycle on topics such as strategic planning, due diligence, risk ● Legal, Public Policy and ● M&A and Business Development experience obtained while acting as an advisory partner to | ||||

Age: 70 Independent Director since: September 2018 | ||||

BOARD COMMITTEES Audit (Chair) Corporate Governance | ||||

QUALIFICATIONS

| ||||

| 17 | 2024 Proxy Statement |  |

| ||||

John | ||||

EXPERIENCE • • Advisor, Royal Bank of Canada, a multinational financial services company (2019 – 2020) • The Hershey Company, a global consumer food company (2003 - 2017) - Chairman, Chief Executive Officer and President (2015 – 2018) - Chief Executive Officer and President (2011 – 2017) - Held roles of increasing responsibility including • Held leadership positions at Mission Foods; Danone Waters of North America, Inc.; Bilbrey Farms and | ||||

OTHER CURRENT AND PRIOR PUBLIC COMPANY BOARDS • Olaplex Holdings, Inc. (since 2023) • Tapestry, Inc. (since 2020) • Colgate-Palmolive Company (since 2015) • Campbell Soup Company (2019 – 2023) • • McCormick & Company, Inc. (2005 – | ||||

2015) KEY QUALIFICATIONS • • • Finance and Accounting expertise developed as a Certified Public Accountant and deepened while overseeing • Unique combination of livestock production, food industry and consumer insights experience, all of which are highly relevant to our industry, due to service as an owner and operator of commercial cattle operations for Bilbrey Farms and Ranch | ||||

Age: 67 Independent Director since: March 2019 | ||||

BOARD COMMITTEES Audit Finance, Strategy and (Chair) | ||||

QUALIFICATIONS

| ||||

| 18 | 2024 Proxy Statement |  |

| |||

Paul Herendeen EXPERIENCE • | |||

|

| ||||

- Advisor to the Chairman and Chief Executive Officer - Executive Vice President and Chief Financial Officer (2016 – 2021) • Executive Vice President and Chief Financial Officer, Zoetis Inc., an animal health company (2014 – 2016) • Chief Financial Officer, Warner Chilcott, a specialty pharmaceuticals company 2001) • Executive Vice President and Chief Financial Officer, MedPointe Pharmaceuticals, a • Principal investor, Dominion Income Management • Held various positions with the investment banking group of Oppenheimer & Company and the capital markets group of Continental Bank Corporation • Senior auditor, Arthur Andersen & Company | ||||

KEY QUALIFICATIONS • • Finance and • • Institutional | ||||

Age: 68 Independent Director Since: December 2020 | ||||

BOARD COMMITTEES Audit Finance, Strategy and Oversight | ||||

QUALIFICATIONS

| ||||

| 19 | 2024 Proxy Statement |  |

| ||||

Lawrence | ||||

EXPERIENCE • - Executive Chairman - Chairman and Chief Executive Officer (2017 - Chief Executive Officer (2016) - Held various leadership roles, including | ||||

• Zatarain's, an American food company - President and - Vice President and Marketing Director (1991 - 1997) • Marketing executive, Quaker Oats Company and Mars Inc.'s Uncle Ben's Company OTHER CURRENT PUBLIC COMPANY BOARDS • The Cooper Companies, Inc. (since 2023) • McCormick & Company, | ||||

Inc. (since 2015), Executive Chairman (since 2023), Chairman (2017 - 2023) KEY QUALIFICATIONS • resulting in his extensive knowledge of consumer trends and a deep understanding of consumer preferences • • Human Capital Management expertise developed through his leadership of • Risk Management and Sustainability experience obtained from his broad executive experience at McCormick, where under his leadership, the company became a | ||||

Incoming Chairman Age: 66 Independent Director Since: September 2018 | ||||

BOARD COMMITTEES Compensation and (Chair) Corporate Governance | ||||

QUALIFICATIONS

| ||||

| 20 | 2024 Proxy Statement |  |

| Craig Wallace EXPERIENCE • President, C.S. Wallace Investments + Strategy, a firm that invests and advises early to mid-stage companies in agribusiness, animal health and human healthcare (since 2019) • Chief Executive Officer, Hannah Pet Hospitals, a veterinary hospital and animal care concept based in Portland, Oregon (2019 – 2021) • Chief Executive Officer and North America Pacific Zone Director, Ceva Santé Animale, a multinational animal health company (2011 – 2019) • Senior Vice President Sales and Marketing, Trupanion, Inc., a pet insurance provider (2010 – 2011) • Fort Dodge Animal Health, a leading global manufacturer of animal health products for the livestock, companion animal, equine, swine, and poultry industries (1989 – 2009) - Held roles of increasing responsibility, including Vice President of U.S. Sales and Vice President of U.S. Marketing KEY QUALIFICATIONS • Animal Health Industry experience gained through his nearly 35 years of service in animal health • Business Leadership and Operations experience gained as the Chief Executive Office of Hannah Pet Hospitals and Ceva Santé Animale • Consumer Products experience through his more than two decades at Fort Dodge Animal Health and Ceva Santé Animale, global manufacturers of animal health products • Institutional Investor Perspective developed through his experience leading an investment and advisory firm that engages with companies in our industry | |||

Age: 60 Independent Director since: March 2024 | ||||

BOARD COMMITTEES Finance, Strategy and Oversight | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 21 | 2024 Proxy Statement |

CLASS II DIRECTORS – TERMS EXPIRING IN 20232026

| Michael Harrington EXPERIENCE • Eli Lilly and | ||||

- Senior Vice President, General Counsel - Vice President and Deputy General Counsel, - Vice President and Deputy General Counsel, Corporate (2004 – 2010) - Managing Director of | |||||

(2001 - 2003) - General Counsel, Asia Pacific (1996 - 2000) OTHER CURRENT PUBLIC COMPANY BOARDS • KEY QUALIFICATIONS • Animal Health/Health Care Industry experience in more than three decades at Eli Lilly, one of the world’s leading global pharmaceutical companies and • Digital, Technology and Cybersecurity expertise • Legal, Public Policy and Regulatory expertise developed and demonstrated having responsibility and oversight of legal and public policy issues, government and regulatory affairs, intellectual property, risk management, corporate governance and compliance • | |||||

Age: 61 Independent Director Since: September 2018 | |||||

BOARD COMMITTEES Innovation, Science and Technology | |||||

QUALIFICATIONS

| |||||

| 22 | 2024 Proxy Statement |  |

| ||||

R. David Hoover | ||||

EXPERIENCE • - Chairman (2002 – 2011) - Chief Executive Officer (2001 – 2011) - President (2000 – 2010) - Chief Operating Officer (2000 – 2001) - Vice Chairman and Chief Financial Officer | ||||

OTHER PRIOR PUBLIC COMPANY BOARDS • Edgewell Personal Care,• Eli Lilly and Company (2009 • Ball Corporation (1996 – 2018) • Steelcase Inc. | ||||

KEY QUALIFICATIONS • • Consumer Products expertise gained beverage, personal care, household and other products, where he developed an understanding of consumer trends and preferences; this developed further while serving on the board of Edgewell • • M&A and Business Development experience gained while at Ball, where he was instrumental as the chief strategist and lead negotiator for Ball in the largest acquisition in the company's history, the purchase of the | ||||

Chairman of the Board Age: 78 Independent Director Since: September 2018 | ||||

BOARD COMMITTEES Compensation and Corporate Governance (Chair) | ||||

QUALIFICATIONS

| ||||

| 23 | 2024 Proxy Statement |  |

| |||

Deborah DVM, Ph.D, DACVCP | |||

EXPERIENCE •Tufts University, a private research university - Senior Fellow, The Fletcher School of Law and Diplomacy and Dean Emerita, Cummings School of Veterinary - Provost and Senior Vice President ad interim (2018 – 2019) - Dean of the Cummings School of Veterinary Medicine (2006 – 2018) • Long-time faculty member and administrator, College of Veterinary Medicine and Biomedical Sciences at Texas A&M University, held the Wiley Chair of Veterinary Medical Education | |||

• Boarded diplomate of the American College of Veterinary Clinical Pharmacology OTHER CURRENT PUBLIC COMPANY BOARDS • Charles River Laboratories International, Inc. | |||

(since 2008) KEY QUALIFICATIONS • emergency veterinary practices • Legal, Public • • Risk Management and Sustainability knowledge acquired from her | |||

|

| Age: Independent Director Since: March 2019 | |||

BOARD COMMITTEES Corporate Governance Innovation, Science and Technology | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 24 | 2024 Proxy Statement |

| Kirk McDonald EXPERIENCE • Chief Executive Officer and member of Global Leadership Team, GroupM North America, a global provider of media and advertising solutions through the development of technology-enabled services •Xandr, Inc., AT&T's advertising division - Chief Business Officer - Chief Marketing Officer • - Chief Marketing Officer, Advertising and Analytics, AT&T Inc. - President, - President, - Chief Advertising Officer, Fortune|Money - Senior Vice President of Network Sales, DRIVEpm and Atlas (both units of Microsoft's advertising business) | |||

OTHER CURRENT PUBLIC COMPANY BOARDS • KEY QUALIFICATIONS • Business Leadership and • Consumer Products experience at leading companies like Microsoft and AT&T • • Human Capital Management insights gained as Chief Executive Officer of GroupM, | ||||

Age: 57 Independent Director Since: March 2019 | ||||

BOARD COMMITTEES Compensation and | ||||

|

Human Capital Innovation, Science and Technology | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health Incorporated | 25 | 2024 Proxy Statement |

| Kathy Turner EXPERIENCE • - Senior Vice President - Corporate Vice President, Europe, Middle East, Africa & Asia (2016 - 2019) - Corporate Vice President, Europe, Middle East & Africa (2014 - 2016) • Abbott Laboratories, a multinational medical devices and | |||

- Held roles of increasing responsibility, | ||||

|

| |

of Global Strategic Operations for the Diagnostics Division KEY QUALIFICATIONS • | |

|

| |

• Business Leadership and Operations experience gained through her positions of increasing responsibility at IDEXX Laboratories and Abbott Laboratories • Global Business Experience gained through her 35 years of international general management, strategy development, product development, and commercial experience, including her service as • Consumer Products experience gained through 10 years of strategy development and commercial experience in multiple roles at Abbott Laboratories in the Nutritional Products Division and Diabetes Care Division • • Research and Development/Innovation experience |

|

TABLE OF CONTENTSAbbott Laboratories

| ||||

Age: 60 Independent Director since: March 2024 | ||||

BOARD COMMITTEES Finance, Strategy and | ||||

QUALIFICATIONS

| ||||

| Elanco Animal Health | ||

| 2024 Proxy Statement |

|

|

|

Corporate Governance | ||

We are committed to the values of effective corporate governance and high ethical standards. Westandards, which we believe these values are conducive tosupport long-term performance. We believe ourOur key corporate governance and ethics policies help enable us to manage our business in accordance with the highest standards of business practice and in the best interests of our shareholders.

Our Corporate Governance Guidelines and committee charters help govern the operation of our Board and its committees in executing their responsibilities. These are reviewed at least annually by the Nominating and Corporate Governance Committee and the full Board and are updated periodically in response to changing regulatory requirements, evolving practices, issues raised by our shareholders and other stakeholders and otherwise as circumstances warrant.

Recent Corporate Governance Enhancements

Our Board continuouslyregularly evaluates our governance-related practices,the Company’s governance profile, taking into account evolving best practices,standards, the needs of our business and feedback we receive from our shareholders and other stakeholders, including as described in “—Shareholder Feedback”“Shareholder Engagement” below. Since December 1, 2020, dueWe have engaged extensively with our shareholders over the last three years on corporate governance matters, and in part2022, we began a process to evolve the Company’s governance practices in response to thisshareholder feedback. Last year, we eliminated the supermajority vote requirements to amend the Company’s Articles of Incorporation and Bylaws. We also adopted proxy access.

As part of a comprehensive governance review following the Company’s 2023 Annual Meeting, and in response to shareholder feedback, we have madein the following enhancements:fall of 2023, the Board initiated a process to implement several additional governance enhancements, including:

| ● | ||||||

|

| ◦ | Commence a process to declassify the Board of Directors; |

| ◦ | Adopt a majority vote standard for uncontested elections of directors; |

| ◦ | Allow shareholders to amend our Bylaws; and |

| ◦ | Allow shareholders under certain circumstances to request special meetings of shareholders |

| ● | Implementing a planned Board leadership change, with Lawrence E. Kurzius to become our next Chairman of the Board following the conclusion of the 2024 Annual Meeting |

| ● | Rotating Board committee leadership, with Michael Harrington assuming the role of Chair of the Corporate Governance Committee and Kirk McDonald assuming the role of Chair of the Compensation and Human Capital Committee following the 2024 Annual Meeting |

| ● | Enhancing disclosure in our annual ESG report and on our website |

We believe these enhancements help demonstrate our responsiveness to shareholder feedback and commitment to good governance. Weeffective corporate governance and ouroversight. Our Board areis committed to continuing to drive progress regarding our corporate governance and looklooks forward to continuing our dialogue with our shareholders and other stakeholders on these topics.

We also recently appointed two new directors to our Board: Kathy Turner and Craig Wallace. Ms. Turner and Mr. Wallace were identified as potential directors by our shareholder Ancora Catalyst Institutional, LP and certain of its affiliates (together, "Ancora") and were appointed to our Board in accordance with our cooperation agreement with Ancora.

| Elanco Animal Health Incorporated | 27 | 2024 Proxy Statement |

Board Leadership Structure

We have always separatedseparate roles for the roles of Board Chairman and Chief Executive Officer. As described in our Corporate Governance Guidelines, our Board currently has a strong, independent, non-executive chairman, R. David Hoover, which we believe helps further strengthen our governance structure. OurAt the conclusion of this year’s Annual Meeting, Lawrence Kurzius, an experienced Executive Chairman and Chief Executive Officer and board leader, will succeed Mr. Hoover as Board Chairman.

At this time, our Board believes thisthe separation of the Board Chairman and Chief Executive Officer roles provides an effective leadership model for Elanco and our Board to help assureensure effective independent oversight at this time.

In addition to the leadership of our Board Chairman, our independent directors have ample opportunity to and regularly do, assess the performance of our Chief Executive Officer and provide him meaningful direction to him.direction. Our Board has strong and effective independent oversight of management:

| ● |

| ● | ||||

Each member of the Audit Committee, |

| ● | ||||

Each |

| ● | ||||

Board and committee agendas are prepared by their independent chairs, based on discussions with all directors and recommendations from senior management; and |

| ● | |||||

All directors are encouraged to request agenda items, additional information and/or modifications to schedules as they deem appropriate. |

| Elanco Animal Health Incorporated | 28 | 2024 Proxy Statement |

Board Oversight

OUR BOARD’S OVERSIGHT OF RISK MANAGEMENT

We have an enterprise risk management program overseen by our Chief Compliance Officer,General Counsel, who is supported by our internal General Auditor. Material enterprise risks, which include competitive, strategic, operational, financial, legal, regulatory and ESG risks, are identified and prioritized by management through both top-down and bottom-up processes. Our management is charged with managing these risks through robust internal processes and controls.

|

Our full Board has responsibility for oversight of our management’s planning for material risks. Our enterprise risk management program is reviewed annually at a full Board meeting and enterprise risks are also addressed in periodic business function reviews. Reviews of certain risk areas are also conducted by relevant Board committees, as described below.

|

OUR BOARD’SBOARD'S OVERSIGHT OF STRATEGY

Our Board and its committees are involved in overseeing our corporate strategy, including major business, organizational and transformational initiatives; capital allocation priorities; and significant acquisitions and other transactions, as well as related integration issues. Our Board engages in robust discussions regarding our corporate strategy at nearly every Board meeting. Our Board’s committees oversee elements of our strategy associated with their respective areas of responsibility.

OUR BOARD’SBOARD'S OVERSIGHT OF HUMAN CAPITAL AND SUCCESSION PLANNING

Our approximately 9,000 full-time global employees help shape the Elanco culture and everything we do for our customers. The Elanco Employee Promise states that together we foster an inclusive culture where everyone can make a difference, encouraging ownership, growth and well-being, while focusing on customers and the animals in their care.

Our Board’s committees oversee elements of our culture associated with their area of responsibility. For instance, theThe Compensation and Human Capital Committee is kept informed of our compensation practices, including pay equity, through recurring updates. The Compensation Committeeupdates and is responsible for periodically discussing with our management and evaluating our performance in the development, implementation and effectiveness of our policies and strategies related to human capital management and diversity in our workforce. The Audit Committee is responsible for oversight of our ethics and compliance program and regularly receives updates on our culture of integrity and the tone set by leaders throughout the organization.

Succession planning for our senior leadership positions is critical to our success. The Compensation and Human Capital Committee reports to our Board on succession planning and leadership development for our Chief Executive Officer as well as certain other executive positions. This topic is discussed formally at least once per year and is also discussed regularly in executive session. The Nominating and Corporate Governance Committee is tasked with focusing on director succession planning. In performing this function, the committee is responsible for recruiting and identifying nominees for election as directors to our Board.

OUR BOARD’SBOARD'S OVERSIGHT OF INFORMATION SYSTEMS AND CYBERSECURITY

We prioritize the trust and confidence of our customers and workforce.workforce, and we evaluate cybersecurity risks on an ongoing basis. Both management and our Board have an overall responsibility for assessing and managing risks from cybersecurity threats. Our dedicated Chief Information Security Officer (“CISO”) is responsible for leading an information security team that helps prevent, identify and appropriately address cybersecurity threats. The team focuses on developingis responsible for the design and implementing strategies and processes to protect the confidentiality, integrity, and availabilityexecution of our assets.

We have been buildingbuilt a risk-based, fit-for-purpose and innovative information security program. Our information security architecture is designed to acceptfocused on designing IT-related solutions that are foundationally secure which accepts and embraceembraces the realities of modern working with a modern, cloud heavy footprint and extended remote workforce. Overall, our program leveragesapproach to cybersecurity governance, risk and aligns with various frameworkscompliance is based on overarching guidelines, standards and goodbest practices includingdeveloped by the U.S. National Institute of Standards and Technology (NIST) Cyber Security Framework, ISO 27000 family(“NIST”), a department of Standards, Information Technology Infrastructure Library (ITIL) Processes, and other good practice control methods.the U.S. Department of Commerce. We expect to continue to mature and enhance our information security program as we progress.program.

The Board oversees our cybersecurity management processes, including appropriate risk mitigation strategies, systems, processes and controls. Our CISO meets with the Audit Committee oversees our program,and separately with the full Board at least twice annually to discuss the status of policies and procedures related to information assetsecurity. These discussions focus on any notable incidents and incident responses, updates on known or perceived cyber threats and the information security team's recent actions taken in response to any such incidents and data protectionthreats. In addition, the Audit Committee and the Board receive updates from the CISO and/or our Chief Information Officer as it relatesneeded.

| Elanco Animal Health Incorporated | 30 | 2024 Proxy Statement |

OUR BOARD'S OVERSIGHT OF ESG AND SUSTAINABILITY

Our Board and management team have identified the management of ESG issues and related sustainability efforts as an important priority for Elanco. The Corporate Governance Committee oversees our overall ESG and sustainability program – including our strategy to financial reportingmanage ESG risks, opportunities and internal controls, including data privacypolicies – as well as sustainability-related programs and network security. Broadgoals. The Compensation and Human Capital Committee periodically evaluates applicable ESG issues, such as our policies and strategies related to workforce inclusion, diversity, equity and accessibility and human capital management. The Innovation, Science and Technology Committee assists the Board in oversight is maintained by our full Board.of research and development initiatives and associated regulatory developments. The Audit Committee oversees policies and practices related to employee health and safety.

The Global Head of ESG and Sustainability provides quarterly updates about our ESG and sustainability program to the Corporate Governance Committee, including an annual update to the full Board regularly receives reports from our Chief Information Security Officer on, among other things, assessments of risks and threats to our security systems and processes to maintain and strengthen information security systems. Our Chief Information Security Officer also meets with the Audit Committee at least annually in executive session without other members of our management present.Board.

| 31 | 2024 Proxy Statement |  |

Board and Committee Information

During 2021,2023, our Board met eight times. Each of our directors attended at least 75% of the total meetings of our Board and the Board committees on which he or she served. Consistent with the expectations in our Corporate Governance Guidelines, each of our directors attended our 20212023 annual meeting of shareholders.

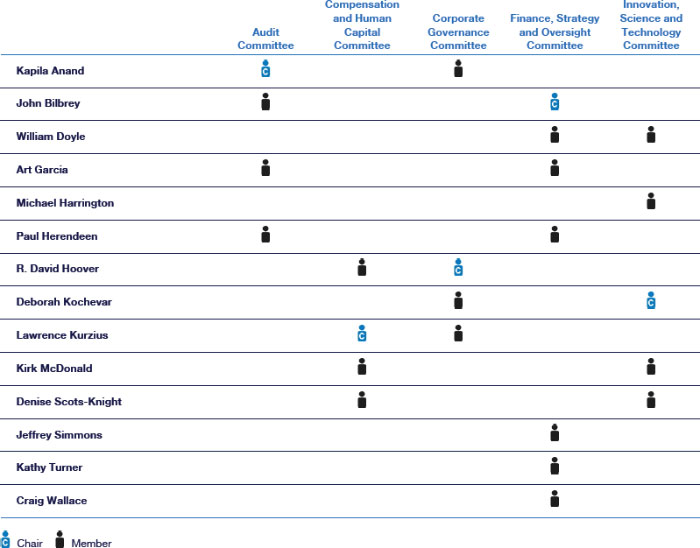

The table below provides the current membership of each of the standing Board committees.

| 32 | |||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

| |||||||||||||||||

|  | ||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

|  | ||||||||||||||||

|

|

BOARD COMMITTEES

Audit Committee

Membership: Kapila Art Garcia John Bilbrey Paul Herendeen Meetings in 2023: 11 | Key Assist our Board in its oversight of: • • • • • • our compliance with legal and regulatory • The Audit Committee is also directly responsible for the appointment, compensation, retention and | ||||

| Our Board has determined that each member of the Audit Committee is independent within the meaning of our independence standards and applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and applicable NYSE listing standards. Each member is also financially literate, and Ms. Anand qualifies as an “audit committee financial expert.” | |||||

| 33 | 2024 Proxy Statement |  |

Compensation and Human Capital Committee

Membership: Lawrence R. David Hoover Denise Scots-Knight Kirk McDonald Meetings in 2023: 5 | Key Assist our Board in its oversight • our • • • • • Elanco’s performance in the oversight, development, implementation and effectiveness of the Company’s policies and strategies relating to its human capital management, including diversity, equity and inclusion in the Company’s workforce. Each Compensation and Human Capital Committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation and Human Capital Committee’s charter is available on our website at www.elanco.com/en-us/about-us/governance/corporate by clicking on the “Compensation and Human Capital Committee Charter” link. Compensation Committee Interlocks and Insider Participation: | ||||

| Our Board has determined that each member of the Compensation and Human Capital Committee is independent within the meaning of our independence standards and applicable NYSE listing standards. | |||||

| 2024 Proxy Statement |

Corporate Governance Committee

Membership: R. David Hoover (Chair) Kapila Anand Deborah Kochevar Lawrence Kurzius Meetings in 2023: 5 | Key Assist our Board in its oversight of: • recommending qualifications required for membership on our Board and its committees; • identifying and recommending candidates for membership on our Board and its committees; • developing and recommending criteria and policies relating to the services of directors; • risk management related to public policy issues, including lobbying priorities and activities, corporate governance and ESG practices and corporate responsibility and sustainability initiatives; • current and emerging political, social and environmental trends and public policy issues that may affect Elanco's operations, performance and public image; and • other matters of corporate governance. The Corporate Governance Committee’s charter is available on our website at | ||||

| Our Board has determined that each member of the Corporate Governance Committee is independent within the meaning of our independence standards. | |||||

Finance, Strategy and Oversight Committee

Membership: John Bilbrey (Chair) William Doyle Art Garcia Paul Herendeen Jeffrey Simmons Kathy Turner Craig Wallace Meetings in 2023: 4 | Key Responsibilities: Assist our Board in its oversight of: •certain of our financial policies, plans and transactions, including mergers and acquisitions (including • • financial risk management, including oversight of Elanco’s financial risk management policies, and • The Finance, Strategy and Oversight Committee’s charter is available on our website at | ||||

| Elanco Animal Health Incorporated | 35 | 2024 Proxy Statement |  |

Innovation, Science and Technology Committee

Membership: Deborah William Michael Kirk Denise Scots-Knight Meetings in 2023: 4 | Key Assist our Board in its oversight of: • • • advancement and augmentation of our product pipeline innovation; and • management of risks related to our research and development program, competitive or disruptive technologies and technologies which Elanco is acquiring or in which we are investing; and our ambition to achieve scientific innovation leadership in the animal health industry. The Innovation, Science and Technology Committee’s charter is available on our website at www.elanco.com/en-us/about-us/governance/corporate by clicking on the “Innovation, Science and Technology Committee Charter” link. | ||||

| Our Board has determined that each member of the | |||||

| Elanco Animal Health Incorporated | 36 | 2024 Proxy Statement |  |

Shareholder OutreachEngagement

We are engagedvalue shareholder feedback and regularly engage in active discussions with our shareholders to facilitate investor understanding aroundgather their feedback on a broad range of subjects, such astopics, including strategy initiatives, business performance, corporate governance, risk and compensation practices and other ESGESG-related initiatives and metrics. We believe this approach to engagement drives increased corporate accountability, improves our decision making and ultimately helps create long-term value. We pursue multiple avenues for shareholder engagement, including videoperiodic reports on our activities, in person and teleconferencevirtual meetings with our shareholders around quarterly earnings, attendance at numerous investor and issuingindustry conferences, and periodic reports on our activities. During 2021, we continued our extensive outreach efforts through an integrated team featuring our President and Chief Executive Officer, Chief Financial Officer, General Counsel and Corporate Secretary, Headgovernance-focused discussions with many of Investor Relations, and senior leaders in our Human Resources department.largest shareholders.

In addition to our regular outreachinvestor relations efforts throughout the year, in the fourth quarter of 2021,2023 and into 2024, we held a series of meetings with many ofundertook our institutional shareholdersannual shareholder engagement initiative focused specifically focused on ESG performancecorporate governance, sustainability and disclosure. As part of this process, we initiated outreachreached out to investorsour largest institutional shareholders representing an aggregate of approximately 63%60% of our outstanding shares and subsequently met with investors(based on ownership reports as of June 30, 2023). Shareholders representing an aggregate of approximately 45%50% of our outstanding shares. Severalshares (8 of our directors, includingtop 15 shareholders) accepted our invitation to engage and met with us to share their feedback.

These meetings were led primarily by either R. David Hoover, the current Chairman of ourthe Board, engaged with investors as partor Lawrence Kurzius, the incoming Chairman of the Board, and generally included one or more additional independent directors. During these discussions. Through these discussions,meetings, we discussed and receivedinvited shareholder input and addressed questions on our governance practices, previous low votes received for directors, corporate strategy, and our executive compensation program,program.

Shareholder feedback we received during these meetings was communicated to the Corporate Governance Committee and governance practices.the Compensation and Human Capital Committee, as appropriate, as well as the full Board of Directors for consideration. These engagement efforts allowed us to better understand our shareholders’shareholders' priorities and perspectives and provided us with useful input concerning these topics.

|

TABLE OF CONTENTSESG and Sustainability Integration

Our Board considers the management of ESG issues and senior leadership have identified Elanco’s Healthy Purpose, including ourrelated sustainability and ESG efforts as an important priority for Elanco. LeadershipThe Board allocates oversight of ESG and sustainability matters among its committees as follows:

Corporate Governance Committee

Assists the Board in oversight of ESG risks, opportunities, initiatives, policies, progress and disclosures with respect to our sustainability-related programs and commitments. Receives quarterly ESG and sustainability updates from across Elanco guides these efforts, including through our Executiveinternal leadership.

Compensation and Human Capital Committee

Assists the Board in oversight of policies and employee-led committeesstrategies related to our ESG program,issues such as human capital management, including diversity, equity and inclusion (“DEI”) initiatives, employee health and safety, and other matters.inclusion.

Audit Committee

Assists the Board in oversight of the production of our annual ESG summary report.

|

Innovation, Science and Technology Committee

Assists the Board in oversight of our employees.

| 37 | 2024 Proxy Statement |  |

Director Independence

Our Board has established that, for a director to qualify as independent, a director must have no material relationship with Elanco other than as a director or, either directly or indirectly, as a partner, significant shareholder or officer of an organization that has a material relationship with Elanco. In making this determination, our Board considers all relevant facts and circumstances and has adopted the categorical independence standards for directors established in the NYSE listing standards.

The Nominating and Corporate Governance Committee has reviewed the applicable legal and NYSE listing standards for Board and committee member independence. A summary of the responses to annual questionnaires completed by each of the directors and a report of transactions with director-affiliated entities are madeprovided to the committee. On the basis of this review, the committee delivers a recommendation to our full Board, which then makes its independence determination.determines independence.

Our Board has determined that each of our directors, other than Mr. Simmons, is independent of Elanco and its management. Mr. Simmons is not independent because he serves as our President and Chief Executive Officer.CEO.

In making these determinations, our Board considered that in the ordinary course of business, relationships and transactions may occur between Elanco and our subsidiaries, on the one hand, andsubsidiaries. Additionally, entities affiliated with directors or their family members on the other hand.were also considered. Dr. Kochevar is employed at an academic institution and Mr. Garcia’s domestic partner is affiliated with a law firm and Mr. McDonald is employed by a for-profit company, with which we have had relationships or transactions in the ordinary course of business. We reviewed our transactions and any payments to each of these entities and found that these transactions and payments were made below the level set forth in applicable independence standards.

In addition to the above standards for director independence, each director who serves on the Audit Committee, Compensation Committee and NominatingHuman Capital Committee and Corporate Governance Committee satisfies the additional standards established by the SEC and NYSE, as applicable, for such committee membership.

|

Director Nomination Process

The Corporate Governance Committee makes recommendations to our Board determined that Michael J. Harrington was not independent because,for director nominations; identifies and screens potential new candidates, including by reviewing recommendations from other directors, management and shareholders; and assesses the ongoing contributions of incumbent directors whose terms are expiring, in each case with input from all other directors. The Corporate Governance Committee may also retain search firms to assist in identifying and screening candidates.

The Corporate Governance Committee will consider director candidates recommended by a shareholder in the same manner as all other candidates recommended by other sources. A shareholder may recommend a candidate at any time of the year by writing to our Corporate Secretary at the timecontact details set forth in “Other Information—Communicating With Us” below.

A shareholder, or group of up to 20 shareholders, owning 3% or more of our separation from Lillyoutstanding common stock continuously for at least three years, could submit director nominees for up to two individuals or 20% of our Board (whichever is greater) for inclusion in 2018, Mr. Harrington served as Lilly’s Senior Vice Presidentour Proxy Statement if the shareholder(s) and General Counsel. Mr. Harrington resigned from this rolethe nominee(s) meet the requirements in January 2020our Bylaws.

Board Diversity and is no longer affiliated with Lilly.Tenure

Our Board consideredis committed to building a Board consisting of directors with diverse experiences and backgrounds. Our Corporate Governance Guidelines state that our Board will select director candidates who represent a mix of backgrounds and experiences that will enhance the factsquality of our Board’s deliberations and decisions and that (a) more than threeBoard membership should reflect diversity in its broadest sense, including persons diverse in geography, gender, race and ethnicity. Additionally, the charter of our Corporate Governance Committee states that the committee will actively consider for selection as directors those persons who are diverse in experience, ideas, gender, race and ethnicity.

Our Board is relatively short-tenured. Five of our directors joined our Board just prior to our initial public offering in September 2018, and five additional directors joined our Board in March 2019, when Eli Lilly exited its remaining ownership in Elanco. In December 2020, we enhanced our Board by adding additional directors to strengthen the financial and industry-specific expertise on our Board and to help drive innovation and improve our operations, and in 2024, we added two additional animal health industry executives to our Board. The four Class III directors we have nominated for re-election at the Annual Meeting have an average tenure of just under five years have passed since we were an affiliate of Lilly and (b) based upon representations made by Mr. Harrington, he is not a party to any relationship that would automatically disqualify him from being considered independent under NYSE listing standards.

| Elanco Animal Health Incorporated | 38 | 2024 Proxy Statement |

Our Corporate Governance Guidelines state that there areis no continuing relationshipslimit on the number of terms for which a director may be elected and that would interfere with Mr. Harrington’s exercise of independent judgment. Consequently, our Board has determined that Mr. Harrington is now an independent director under NYSE listing standards.

Board Evaluations

In the spirit of our values of excellence and continuous improvement, our Board is committed to regular Board and Committee assessments. This helps ensure that our Board’s governance and oversight responsibilities are well executed and updated to reflect best practices.

At the Compensation Committee, orend of each quarterly Board meeting, our Board meets in executive session, both with and without our Chief Executive Officer, to discuss whether the Nominatingmeeting’s objectives were satisfied and to identify issues that might require additional dialogue. Each of our Board’s standing committees also regularly meets in executive session for the same purposes.

Our Board also conducts an annual self-evaluation process, which is led by the Chairman of our Board and the Corporate Governance Committee. Directors complete a comprehensive questionnaire evaluating the performance of our Board as a whole and the committees on which the director serves. The directors’ responses are aggregated and anonymized to encourage the directors to respond candidly and maintain the confidentiality of responses. The results are reviewed by the Corporate Governance Committee and summarized for the Board, which reviews the results in executive session. Each Board committee also separately reviews the feedback received for such committee in executive session. The Chairman then conducts one-on-one meetings with each director to discuss the evaluations and any other matters raised by the directors.

We believe this annual evaluation process provides our Board and its committees with valuable insights regarding areas where our Board functions effectively as well as areas where our Board may improve. Recommendations for improvement derived from the annual evaluation process are used to adjust our Board’s future agendas and practices and responses to the evaluations also inform the topics for director education over the course of the following year.

Related Party Transactions

Our Board has adopted a written policy, which is referred to as the “related person transaction policy,” for the review of any transaction, arrangement or relationship in which we are a participant and one of our executive officers, directors, director nominees or beneficial holders of more than 5% of Elanco’s total equity (or their immediate family members), each of whom is referred to as a “related person,” has a direct or indirect material interest.

If a related person proposes to enter into such a transaction, arrangement or relationship, which is referred to as a “related person transaction,” the related person must report the proposed related person transaction to our EVP, General Counsel and Corporate Secretary, who will report it to the Audit Committee. The policy calls for the proposed related person transaction to be reviewed and, if deemed appropriate, approved by the Audit Committee. In approving or rejecting such proposed transactions, the Audit Committee considers all relevant facts and circumstances. The Audit Committee will approve only those transactions that, in light of known circumstances, are deemed to be in ourthe Company’s best interests. In the event that any member of the Audit Committee is not a disinterested person with respect to the related person transaction under review, that member will be excluded from the consideration of such related person transaction; provided, however, that such Audit Committee member may be counted in determining the presence of a quorum at the meeting of the Audit Committee at which such transaction is acted upon.

| 39 | 2024 Proxy Statement |  |

TABLE OF CONTENTSBusiness Ethics, Compliance and Privacy

We govern our Board before his term expires, Sachem Head is entitled to recommend another individual to be appointed to our Board and, subject to certain conditions, our Board shall appoint such individual to the same class of our Board on which Mr. Ferguson or Mr. Herendeen, as applicable, served.

Elanco's Ethics & Compliance Officer, who arefunction is responsible for designing, implementing,our compliance program which includes global compliance policies and continuously monitoring our ethicsprocedures, risk assessments, anti-corruption due diligence, training and compliance program.communications, and conflicts of interest. Additionally, we have a global network of Ethicsethics and Compliance Partners and Championscompliance partners that support program implementation and execution locally. Our Integrated Controls Committee, comprised

Elanco is committed to the ethical management and processing of cross-functional senior leaders, provides program oversight. personal data related to our customers, consumers, employees and other individuals. We are transparent about how we process personal data and are intentional about protecting it, while being respectful of individuals’ privacy rights. Elanco’s dedicated Global Privacy Office manages the privacy inquiries of our customers and employees and ensures compliance with privacy laws and regulations globally.

Code of Conduct

The Chief Compliance Officer provides quarterly reports to senior leaders and the Audit Committee.

We have also adopted a Financial Code of Ethics that contains the ethical principles by which our Chief Executive Officer, Chief Financial Officer and other financial officers are expected to conduct themselves when carrying out their duties and responsibilities. It is available atwww.elanco.com/en-us/about-us/governance/corporate, by clicking on the “Financial Code of Ethics” link. Any amendments to or waivers from the Elanco Code of Conduct or our Financial Code of Ethics will be disclosed on our website within the time period required by applicable law following the date of such amendment or waiver.

Other Information

We have adopted Corporate Governance Guidelines in accordance with the corporate governance rules of the NYSE, whichthat serve as a flexible framework within which our Board and its committees operate. These guidelines cover a number of areas, including the role of our Board, Board composition, director independence, director selection, qualification and election, director compensation, executive sessions, key Board responsibilities, Chief Executive Officer evaluation, succession planning, risk management, Board leadership and operation, conflicts of interest and other information. You can learn more about our corporate governance by visiting www.elanco.com/en-us/about-us/governance/corporate, where you will find our Corporate Governance Guidelines, each standing Board committee charter and other corporate governance-related information.

Each of the above documents, along with the Elanco Code of Conduct and our Financial Code of Ethics, is available in print upon request to our Corporate Secretary through the means described in “Other Information—Communicating With Us” below.

| 40 | 2024 Proxy Statement |  |

Non-Employee Director Compensation | ||

Non-employee directors receive compensation for their service to our Board. As an Elanco employee, Mr. Simmons, our President and Chief Executive Officer,CEO, does not receive compensation for his service as a director.

The Compensation and Human Capital Committee annually reviews the total compensation of our Non-Employee Directorsnon-employee directors and each element of our Non-Employee Directornon-employee director compensation program. As part of this process, the Compensation and Human Capital Committee evaluates market data provided by its independent compensation consultant, WTW,Willis Towers Watson (“WTW”) and makes a recommendation to our Board. Our Board determines the form and amount of Non-Employee Directornon-employee director compensation after reviewing the Compensation and Human Capital Committee’s recommendation. Our Amended and Restated 2018 Elanco Stock Plan (the “2018 Stock Plan”) provides for an annual limit of $800,000 for all compensation paid to a Non-Employee Director.

SUMMARY OF 2023 NON-EMPLOYEE DIRECTOR ANNUAL COMPENSATION(1) PROGRAM

| | Role | | | Cash ($) | | | Deferred Stock Units ($) | |

| | All Non-Employee Directors | | | 90,000 | | | 210,000 | |

| | Chairman of the Board | | | 150,000 | | | — | |

| | Chair of the Audit Committee | | | 25,000 | | | — | |

| | Chair of the Compensation Committee | | | 20,000 | | | — | |

| | Other Committee Chairs | | | 16,000 | | | — | |

Cash ($) | Deferred Stock Units ($) | ||

| All Non-Employee Directors | 90,000 | 240,000 | |

| Chairman of the Board | 150,000 | — | |

| Chair of the Audit Committee | 25,000 | — | |

| Chair of the Compensation and Human Capital Committee | 20,000 | — | |

| Other Committee Chairs | 16,000 | — |

Cash Retainers. Until November 2021, our Non-Employee DirectorsRetainers. Our non-employee directors each received an annual cash retainer of $70,000,$90,000, the Chairman of our Board received an additional annual cash retainer of $100,000,$150,000, the Chair of the Audit Committee received an additional annual cash retainer of $18,000,$25,000, the Chair of the Compensation and Human Capital Committee received an additional annual cash retainer of $20,000 and the Chair of each of the three other four standing committees of our Board received an additional annual cash retainer of $16,000. In November 2021, our Board approved an increase in the annual cash retainer payable to Non-Employee Directors to $90,000, an increase in the additional cash retainer payable to the Chairman of the Board to $150,000, an increase in the additional cash retainer payable to the Chair of the Audit Committee to $25,000, and an increase in the additional cash retainer payable to the Chair of the Compensation Committee to $20,000. The additional annual cash retainer payable to the Chair of the other three standing committees of our Board remained at $16,000. These increases were effective immediately. All cash retainers are paid in monthlyquarterly installments.

Equity-Based Awards. A substantial portion of each Non-Employee Director’snon-employee director’s annual retainer is in the form of equity awards. Pursuant to the Elanco Animal Health, Inc. Directors’ Deferral Plan (the “Directors’ Deferral Plan”), Non-Employee Directorsnon-employee directors are granted deferred stock units (“DSUs”) on or about November 30 of each year. Each DSU is the economic equivalent of one share of our common stock. These DSU awards are fully vested on the grant date and are subject to mandatory deferral under the terms of the Directors’ Deferral Plan until the second January following the recipient’s departure from service on our Board. In November 2021,2023, the number of DSUs underlying each DSU award was determined by dividing $210,000 (increased from $180,000 in 2020)$240,000 by the per share closing price of our common stock on the date of grant.

| Elanco Animal Health Incorporated | 41 | 2024 Proxy Statement |

Other Compensation. Our non-employee directors may be reimbursed for reasonable out-of-pocket travel expenses incurred in connection with attendance at Board and committee meetings and other Board-related activities.

|